Credit Where It’s Due

Since the Federal Reserve began raising interest rates in early 2022, investors have understandably focused a great deal on the appropriate duration positioning within fixed income portfolios. Even as we have arguably reached a point where we are close to seeing the end of the interest rate hiking cycle, questions about the right time to add duration continue to dominate our conversations with advisors.

However, it is important to remember the other sources of fixed income return. While duration has received most of the attention, the real performance story this year has been in credit. Despite continuing talk about recession fears, high yield option-adjusted spreads have tightened by almost 100 basis points since January 1, and the best performing fixed income asset classes this year are the ones that carry the most spread exposure.

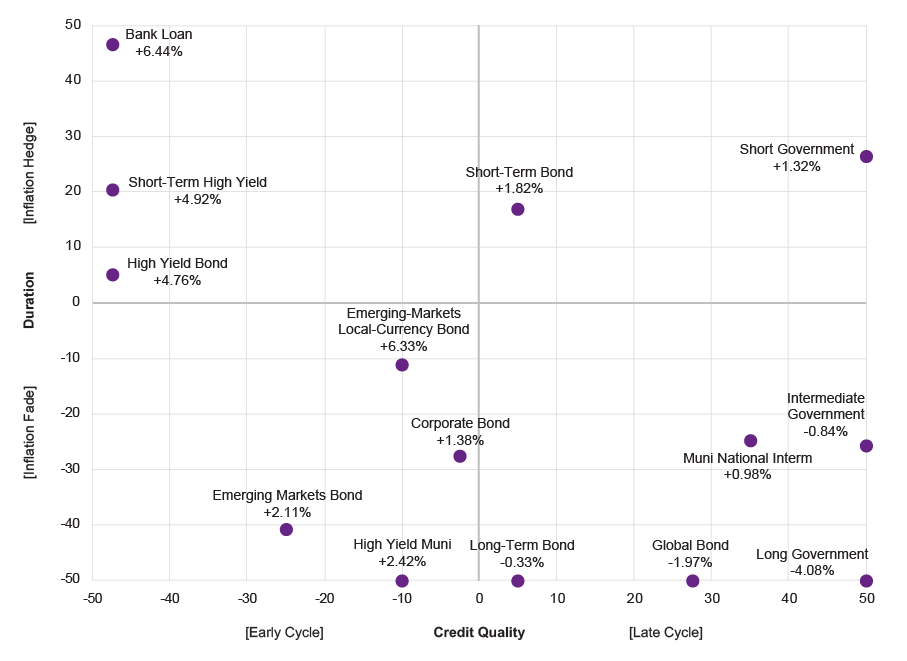

High Yield and Bank Loans Are Top Performers This Year (1/1/23–8/22/23)

Source: Natixis Investment Managers Solutions

Lower Credit Quality, Higher Performance

While duration has remained a performance headwind so far this year, credit is the bigger differentiator – every major fixed income asset class with an average quality rating of BBB+ or lower has seen positive returns year-to-date. Only those asset classes with the combination of longer duration and higher quality have remained pressured.

Why has credit performed this year? While inflation remains a much-discussed risk, market-based inflation expectations are relatively flat on a year-to-date basis. The increase we have seen in yields has been driven by real yields, which are a reflection of growth expectations rather than inflation expectations.

Comparison of 10-Year Yields (5/1/23–8/15/23)

Source: Natixis Investment Managers Solutions; Bloomberg

Robust Economic Growth Supports Credit Valuations

Spreads have tightened as the market has come to appreciate the robustness of growth and is pricing in a lower likelihood of a credit event. This certainly makes sense given the strength of corporate balance sheets and the persistence of US consumer spending. Corporate interest coverage ratios remain near all-time highs, suggesting firms have ample cash to meet debt service obligations.

Consumer Spending Strength Persists

In addition, given that the US economy is roughly 70% consumption-based, the persistent strength of the US consumer provides another column of support for credit valuations. While consumer savings are not as high as they were coming out of the pandemic, the ratio of debt payments to disposable income remains near historical lows, suggesting that consumers can continue to spend unless we begin to see labor market weakness in the form of widespread job losses.

Financial Obligations Ratio: Household Debt Payments to Total Disposable Income

Source: Natixis Investment Managers Solutions; Bloomberg

While we believe there is a strong argument for extending duration in this environment, it’s important to remember the other potential sources of return in your fixed income allocation and maintain the appropriate balance given your investment objectives.

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Natixis Investment Managers, or any of its affiliates. The views and opinions are as of August 25, 2023 and may change based on market and other conditions. There can be no assurance that developments will transpire as forecasted, and actual results may vary.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Investors should fully understand the risks associated with any investment prior to investing.

This material may not be redistributed, published, or reproduced, in whole or in part. Although Natixis Investment Managers believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy or completeness of such information.

This document may contain references to copyrights, indexes and trademarks that may not be registered in all jurisdictions. Third party registrations are the property of their respective owners and are not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis”). Such third-party owners do not sponsor, endorse or participate in the provision of any Natixis services, funds or other financial products.

Provided by Natixis Distribution, LLC, 888 Boylston St., Boston, MA 02199. Natixis Investment Managers includes all of the investment management and distribution entities affiliated with Natixis Distribution, LLC and Natixis Investment Managers S.A. Natixis Advisors, LLC provides advisory services through its division Natixis Investment Managers Solutions. Advisory services are generally provided with the assistance of model portfolio providers, some of which are affiliates of Natixis Investment Managers, LLC.

5932122.1.1