60/40 Portfolio Simplicity

"Simplicity does not precede complexity, but follows it."

~ Alan Perlis, computer scientist

For two decades, I’ve worked with individuals, advisors, and institutions to develop asset allocations – that perfect mix of stocks and bonds – to ensure financial success. And you know what? That mix nearly always falls within spitting distance of 60% stocks and 40% bonds. Sure, there are outlier allocations, but the 60/40 (a.k.a. “moderate” or “balanced”) allocation dominates all others in its popularity and usage.

This simple asset allocation provides investors with the best of both worlds – a healthy dose of equities to produce long-term growth and enough in bonds to preserve capital and offer modest income. Importantly, the bonds help dampen volatility so the investor can stick with the allocation through turbulent times.

But this simple allocation can quickly turn complex as the pie gets sliced into many pieces in hopes of outperforming a benchmark. Considerable time is spent looking for “alpha” opportunities in the pursuit of higher returns, lower risk, and/or broader diversification.

Just how simple?

In our experience, it’s not uncommon for a balanced model to hold 20 or more investments. Some of these are core beta positions, some offer unique risk factors, some are tactical positions, and some are just redundant. Part of the portfolio consultant’s job is to uncover those redundancies and offer suggestions for consolidation. The golf analogy I often use: You’re only allowed 14 clubs in your bag so make sure each club has a role – having three drivers is wasteful. The same is true with investments: Don’t overcomplicate it, simple is often better.

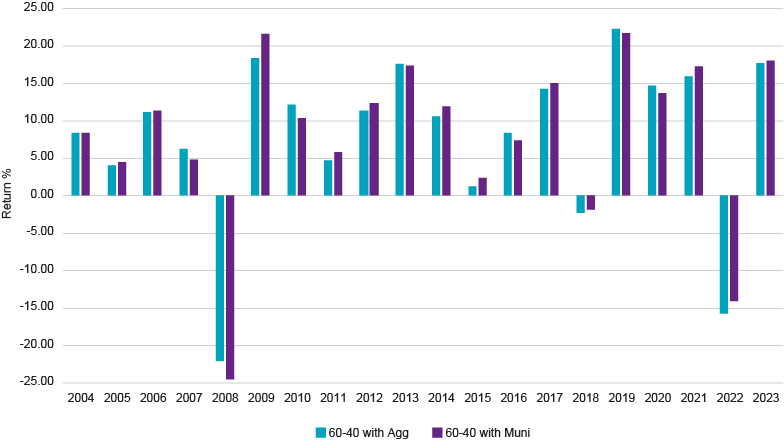

So how simple should a portfolio be? It depends on who you ask. In The Simple Path to Wealth, author J.L. Collins argues for a two-fund portfolio – a total stock market index fund and a total bond market index fund. Figure 1 shows how a 60/40 portfolio would have done historically, using the S&P 500® mixed with the Barclays Aggregate Bond Index or the Barclays Municipal Bond Index. With only three negative years in the last 20, this mix has been a relentless compounding vehicle for investors. It’s earned well above the 4% safe withdrawal rate most retirees benchmark themselves against.

Personally, I follow a slightly different approach – one published by financial advisor and author Rick Ferri, CFA®. He advocates for a four-fund portfolio that includes US stocks, international stocks, US investment grade corporate bonds, and real estate. I take some liberties and get that done with eight mutual funds.

But the simplest approach is to buy a single balanced fund. The Moderate Allocation category is composed of balanced funds with 50–70% in stocks and the rest in bonds. They may be used on a standalone basis or within a broader portfolio. Over 700 funds belong to the Moderate Allocation peer group with the oldest fund approaching its 100th birthday. By assets, the category ranks as the 6th largest and twice the size of the other four allocation categories combined (Figure 2).

While easy to implement, allocating to a single balanced fund isn’t ideal for high-net-worth investors for a number of reasons. First, these funds don’t offer any customization or flexibility – the portfolio manager determines the allocation, geographic diversification, market cap, credit quality, and duration. Second, the fees are inflexible to investment levels. All shareholders pay the same management fee, which averages 103 basis points for the category. Finally, these funds are insensitive to taxable investors with just 1% allocating to tax-exempt municipal bonds.

Fortunately, through a separately managed account (SMA), investors can own a simple 60/40 stock/bond portfolio with tax-efficiency, lower fees, and flexible customizations. The rub is that the minimums are higher – generally in the $250,000 range for this type of account.

Tax-sensitive investing

The stock portion of the account employs a Direct Indexing strategy which attempts to match an index’s performance pre-tax and outperform it on an after-tax basis. By owning a subset of the index’s holdings, the manager can systematically tax loss harvest stocks that have declined in value, replace them with another stock, and avoid a wash sale. The banked losses can be used to offset capital gains realized in other parts of the portfolio or to offset $3,000 in ordinary income annually. Indexing also keeps a lid on the account’s management fees.

The bond sleeve is actively managed, because indexing isn’t practical due to the sheer number of bonds in the index. Investors benefit from the manager’s expertise in selecting credit, duration, and sectors, and get better pricing on bulk purchases.

The tax efficiency of the account is optimized when Direct Indexing is paired with municipal bonds. The 60% in stocks can generate tax losses while the 40% in municipal bonds can provide tax-exempt income. Depending on the client’s domicile, they might be able to request all the bonds be issued by their home state. In that case, the interest income is exempt from both federal and state taxes. Clients in lower tax brackets may be better off with taxable bonds, so they can opt for a mix of high-quality government and investment grade corporate bonds.

Customization and tax-efficiency

While the 60/40 allocation is often the default option for investors, an SMA offers the flexibility to select a different allocation. The S&P 500® large cap is the most popular index option, but more diversified all-cap and global indices are also available.

The managed account structure allows for customization since it holds individual stocks and individual bonds, each with their own cost basis and tax lots. That means the portfolio manager can accept securities in-kind, which is often low-basis stock the investor owns. Taking securities in-kind can reduce the tax burden on transitioning assets. This is especially attractive to clients who are changing advisors, custodians, or outsourcing management for the first time.

Beyond customization, the investor can personalize their one-account balanced portfolio by aligning it with their personal values. That might mean excluding a particular stock where they already have adequate exposure. Or it could mean excluding companies involved in a particular business, like the manufacture or sale of alcohol.

Finding the right portfolio

At the end of the day, the right portfolio for an investor is the one they can stick with through the market’s ups and downs. The 60/40 is a time-tested allocation that usually fits that bill. Because it can be implemented in a variety of ways, investors need to think about how simple or complex they want to get.

Harkening back to Perlis’ quote, simplicity is achieved after first tinkering, exploring, and then realizing that complexity isn’t necessary. There’s something elegant and compelling about the simple 60/40 that’s mostly indexed, tax-managed, low fee, and available with a few, but not too many, customization options (Figure 3).

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

Natixis Advisors, LLC does not provide tax advice. Please consult with your financial advisor or tax professional.

This material is provided for informational purposes only and should not be construed as investment advice. Investors should not make choices solely on the content contained herein, nor should they rely on this information to apply to their specific situation or any specific investments under consideration. This is not a solicitation to buy or sell any specific security.

Although Natixis Investment Managers believes the information provided in this material to be reliable, it does not guarantee the accuracy, adequacy, or completeness of such information.

~ Alan Perlis, computer scientist

For two decades, I’ve worked with individuals, advisors, and institutions to develop asset allocations – that perfect mix of stocks and bonds – to ensure financial success. And you know what? That mix nearly always falls within spitting distance of 60% stocks and 40% bonds. Sure, there are outlier allocations, but the 60/40 (a.k.a. “moderate” or “balanced”) allocation dominates all others in its popularity and usage.

This simple asset allocation provides investors with the best of both worlds – a healthy dose of equities to produce long-term growth and enough in bonds to preserve capital and offer modest income. Importantly, the bonds help dampen volatility so the investor can stick with the allocation through turbulent times.

But this simple allocation can quickly turn complex as the pie gets sliced into many pieces in hopes of outperforming a benchmark. Considerable time is spent looking for “alpha” opportunities in the pursuit of higher returns, lower risk, and/or broader diversification.

Just how simple?

In our experience, it’s not uncommon for a balanced model to hold 20 or more investments. Some of these are core beta positions, some offer unique risk factors, some are tactical positions, and some are just redundant. Part of the portfolio consultant’s job is to uncover those redundancies and offer suggestions for consolidation. The golf analogy I often use: You’re only allowed 14 clubs in your bag so make sure each club has a role – having three drivers is wasteful. The same is true with investments: Don’t overcomplicate it, simple is often better.

So how simple should a portfolio be? It depends on who you ask. In The Simple Path to Wealth, author J.L. Collins argues for a two-fund portfolio – a total stock market index fund and a total bond market index fund. Figure 1 shows how a 60/40 portfolio would have done historically, using the S&P 500® mixed with the Barclays Aggregate Bond Index or the Barclays Municipal Bond Index. With only three negative years in the last 20, this mix has been a relentless compounding vehicle for investors. It’s earned well above the 4% safe withdrawal rate most retirees benchmark themselves against.

Figure 1: Yearly Returns for 60/40 Portfolios (2004–2023)

Source: FactSet; Natixis Investment Managers Solutions

Personally, I follow a slightly different approach – one published by financial advisor and author Rick Ferri, CFA®. He advocates for a four-fund portfolio that includes US stocks, international stocks, US investment grade corporate bonds, and real estate. I take some liberties and get that done with eight mutual funds.

But the simplest approach is to buy a single balanced fund. The Moderate Allocation category is composed of balanced funds with 50–70% in stocks and the rest in bonds. They may be used on a standalone basis or within a broader portfolio. Over 700 funds belong to the Moderate Allocation peer group with the oldest fund approaching its 100th birthday. By assets, the category ranks as the 6th largest and twice the size of the other four allocation categories combined (Figure 2).

Figure 2: Moderate Allocation Dominates All Other Categories

| Morningstar Categories | Total Net Assets ($B) | Rank | Typical Volatility Similar to Equity Exposure Of: |

|---|---|---|---|

| Moderate Allocation | 763 | 6 | 50–70% |

| Moderately Aggressive Allocation | 168 | 24 | 70–85% |

| Moderately Conservative Allocation | 117 | 32 | 30–50% |

| Aggressive Allocation | 13 | 70 | >85% |

| Conservative Allocation | 11 | 74 | 15–30% |

Source: Morningstar Direct, as of 01/31/2024

What about high-net-worth investors?While easy to implement, allocating to a single balanced fund isn’t ideal for high-net-worth investors for a number of reasons. First, these funds don’t offer any customization or flexibility – the portfolio manager determines the allocation, geographic diversification, market cap, credit quality, and duration. Second, the fees are inflexible to investment levels. All shareholders pay the same management fee, which averages 103 basis points for the category. Finally, these funds are insensitive to taxable investors with just 1% allocating to tax-exempt municipal bonds.

Fortunately, through a separately managed account (SMA), investors can own a simple 60/40 stock/bond portfolio with tax-efficiency, lower fees, and flexible customizations. The rub is that the minimums are higher – generally in the $250,000 range for this type of account.

Tax-sensitive investing

The stock portion of the account employs a Direct Indexing strategy which attempts to match an index’s performance pre-tax and outperform it on an after-tax basis. By owning a subset of the index’s holdings, the manager can systematically tax loss harvest stocks that have declined in value, replace them with another stock, and avoid a wash sale. The banked losses can be used to offset capital gains realized in other parts of the portfolio or to offset $3,000 in ordinary income annually. Indexing also keeps a lid on the account’s management fees.

The bond sleeve is actively managed, because indexing isn’t practical due to the sheer number of bonds in the index. Investors benefit from the manager’s expertise in selecting credit, duration, and sectors, and get better pricing on bulk purchases.

The tax efficiency of the account is optimized when Direct Indexing is paired with municipal bonds. The 60% in stocks can generate tax losses while the 40% in municipal bonds can provide tax-exempt income. Depending on the client’s domicile, they might be able to request all the bonds be issued by their home state. In that case, the interest income is exempt from both federal and state taxes. Clients in lower tax brackets may be better off with taxable bonds, so they can opt for a mix of high-quality government and investment grade corporate bonds.

Customization and tax-efficiency

While the 60/40 allocation is often the default option for investors, an SMA offers the flexibility to select a different allocation. The S&P 500® large cap is the most popular index option, but more diversified all-cap and global indices are also available.

The managed account structure allows for customization since it holds individual stocks and individual bonds, each with their own cost basis and tax lots. That means the portfolio manager can accept securities in-kind, which is often low-basis stock the investor owns. Taking securities in-kind can reduce the tax burden on transitioning assets. This is especially attractive to clients who are changing advisors, custodians, or outsourcing management for the first time.

Beyond customization, the investor can personalize their one-account balanced portfolio by aligning it with their personal values. That might mean excluding a particular stock where they already have adequate exposure. Or it could mean excluding companies involved in a particular business, like the manufacture or sale of alcohol.

Finding the right portfolio

At the end of the day, the right portfolio for an investor is the one they can stick with through the market’s ups and downs. The 60/40 is a time-tested allocation that usually fits that bill. Because it can be implemented in a variety of ways, investors need to think about how simple or complex they want to get.

Harkening back to Perlis’ quote, simplicity is achieved after first tinkering, exploring, and then realizing that complexity isn’t necessary. There’s something elegant and compelling about the simple 60/40 that’s mostly indexed, tax-managed, low fee, and available with a few, but not too many, customization options (Figure 3).

Figure 3: SMAs offer more opportunities for funding, customization and tax management

| 60–40 Mutual Fund | 60–40 SMA | |

|---|---|---|

| # of Underlying Strategies | 1 | 2 |

| Ownership | Comingled | Direct |

| Tax Efficiency | Minimal | HIgh |

| Tax Control | None | High |

| Funding | Cash | Existing securities and cash |

| Customization | None | Yes, with limitations |

| Fees | 1% average | Less than 0.4% |

| Minimum Investment | $1,000 | $250,000 |

Natixis Advisors, LLC does not provide tax advice. Please consult with your financial advisor or tax professional.

This material is provided for informational purposes only and should not be construed as investment advice. Investors should not make choices solely on the content contained herein, nor should they rely on this information to apply to their specific situation or any specific investments under consideration. This is not a solicitation to buy or sell any specific security.

Although Natixis Investment Managers believes the information provided in this material to be reliable, it does not guarantee the accuracy, adequacy, or completeness of such information.

6490207.1.1