5 Trends in Model Investment Portfolios – Year-End 2022

Natixis Investment Managers Solutions portfolio consultants monitor asset classes, investment products and market action, both in real time and from a historical perspective. See which trends influenced financial advisors’ asset allocation decisions in their moderate model portfolios as 2022 drew to a close.

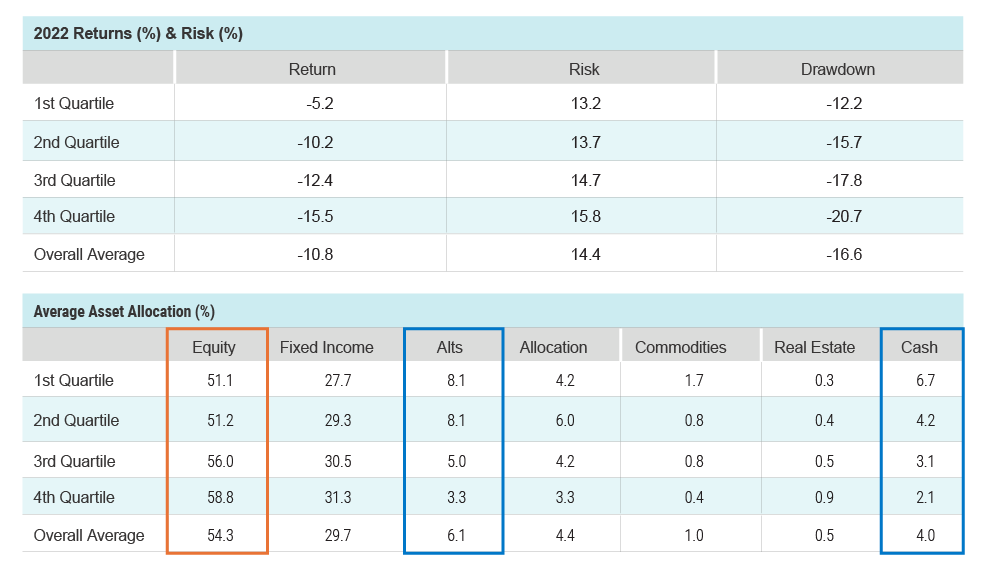

#1 – Value Stocks and Short Duration Bonds Drove Top Quartile Performance

Comparing the asset allocations of 1st and 2nd quartile portfolios would lead you to conclude their return and risk profiles should be similar. In fact, the top quartile portfolios outperformed by 5% with a 3.5% lower drawdown, which we found interesting. Further investigation showed that the top quartile portfolios had a bias towards value stocks and shorter duration bonds, which were both outperformers in 2022.

Asset Allocation by Return Quartile in Moderate Model Portfolios

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 163 moderate portfolios submitted for review from July to December 2022. Data as of 12/31/2022.

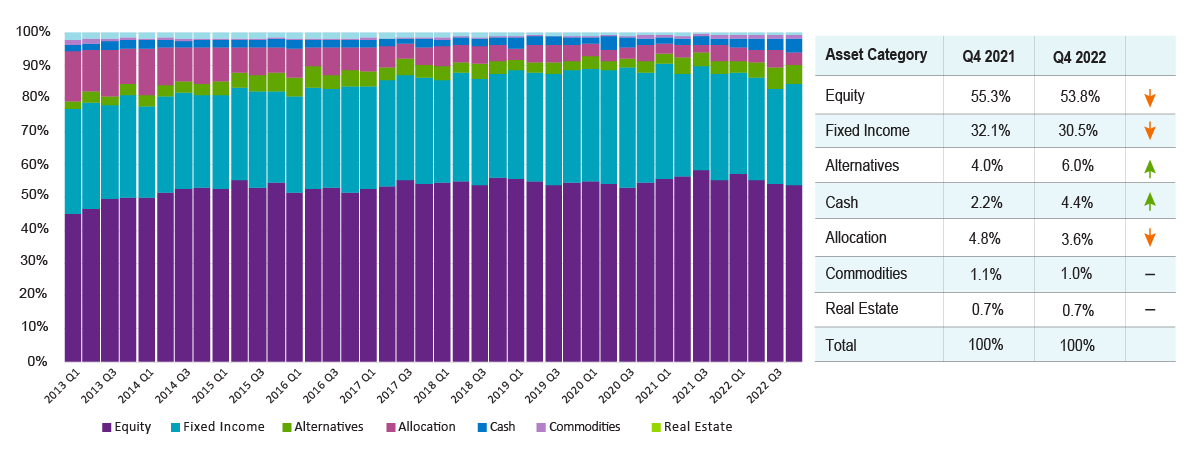

#2 – Risk-Off Posturing Resulted in Meaningful Additions to Cash and Alternatives

There were very few places to hide in equities and fixed income last year, so advisors increased allocations to cash and alternatives to sidestep volatility. Cash holdings reached a ten-year high of 4.4%, while alternative categories such as Options Trading, Event Driven, and Systematic Trend hit their highest levels since 2016. Nearly 70% of advisors are now using alternatives in their models, up from around 50% in the previous five years.

Advisors De-risked Their Portfolios, Favoring Cash and Alternatives

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 163 moderate portfolios submitted for review from July to December 2022. Data as of 12/31/2022.

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 163 moderate portfolios submitted for review from July to December 2022. Data as of 12/31/2022.

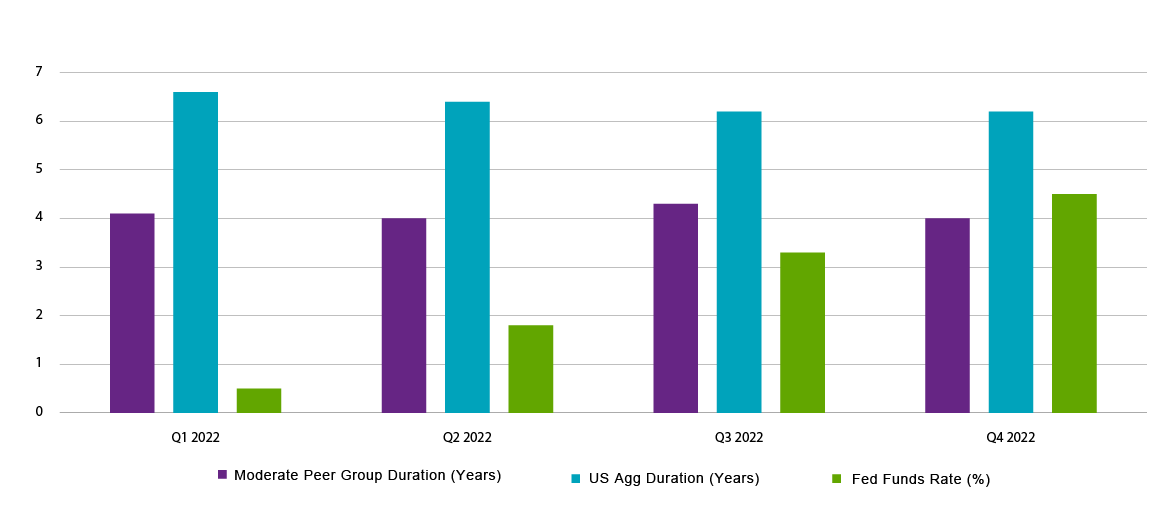

As advisors positioned their portfolios defensively for Fed rate hikes, fixed income duration ended 2022 at 4.0 years, well below the 6.2 years of the Bloomberg US Aggregate Bond Index. Since our duration calculation excludes cash and money market funds (+2.2% increase), duration would have been lower if advisors had kept that money in ultrashort bonds instead of opting for the NAV stability of cash and money markets.

Despite Rising Rates, Average Duration Remained Stable

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 163 moderate portfolios submitted for review from July to December 2022. Data as of 12/31/2022.

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 163 moderate portfolios submitted for review from July to December 2022. Data as of 12/31/2022.

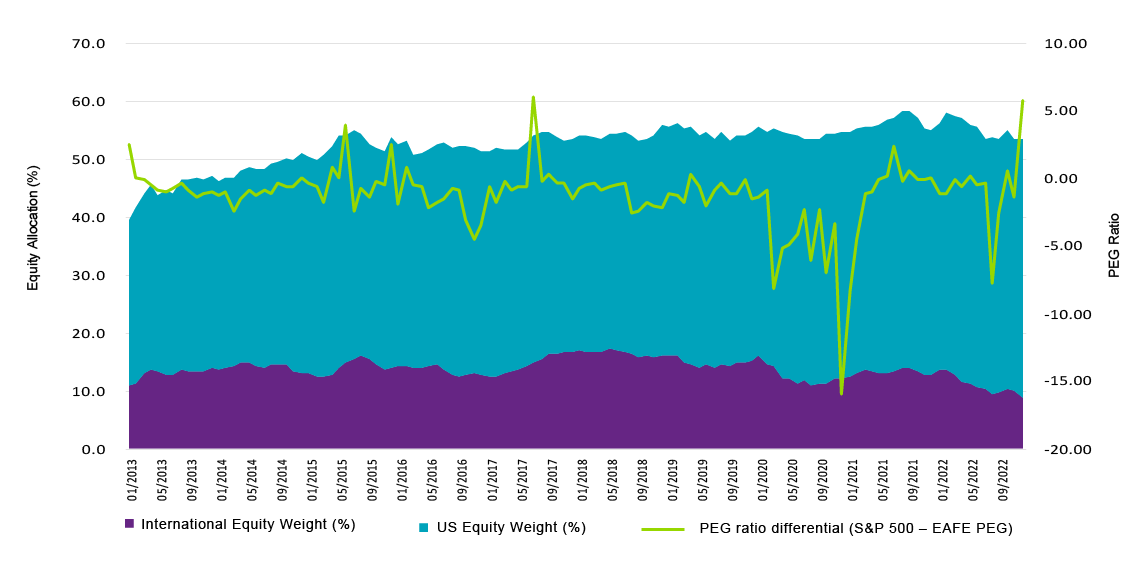

International stocks, both developed and emerging, represent just 17% of the typical equity sleeve in advisors’ model portfolios – less than half of the neutral benchmark weight of 40% for the ACWI ex-US index. While international stocks have underperformed for a sustained period, 2022 proved to be a turning point. International outperformance was aided by dollar weakness, no escalation in the Ukraine conflict, avoiding an energy crisis, and a meaningfully lower allocation to technology stocks.

International Equity Allocations at All-Time Lows

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 163 moderate portfolios submitted for review from July to December 2022. Data as of 12/31/2022.

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 163 moderate portfolios submitted for review from July to December 2022. Data as of 12/31/2022.

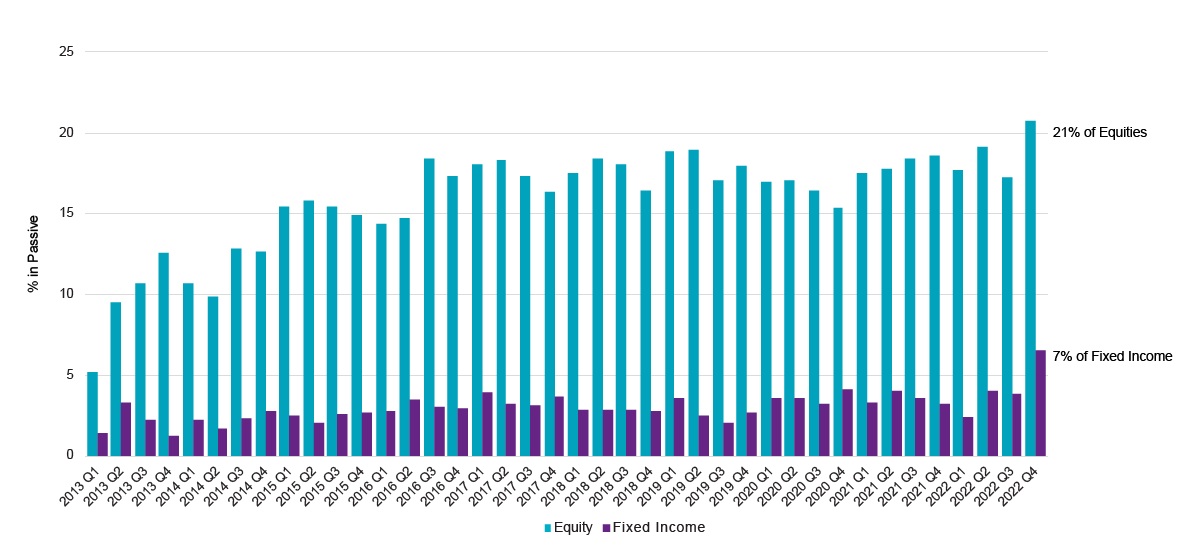

Last year provided plenty of opportunities to harvest losses in both equities and fixed income. Banking losses for tax purposes allowed investors to reduce their tax liability in 2022 and carry forward losses indefinitely in taxable accounts. Industry data showed active mutual funds with $941 billion in outflows while passive ETFs took in $549 billion. We suspect many of those active funds were swapped into passive beta strategies for the 30-day wash sale period and anticipate active allocations to increase in 2023.

Passive Allocations Reached All-Time Highs

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 163 moderate portfolios submitted for review from July to December 2022. Data as of 12/31/2022.

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 163 moderate portfolios submitted for review from July to December 2022. Data as of 12/31/2022.

Year-End Trends in Model Investment Portfolios

Key trends including best performing allocations, tactics for sidestepping volatility, and below-benchmark duration in fixed income holdings.

Download PDF

Learn More

Submit your model portfolio for in-depth analysis including sources of risk, return, and diversification.

Contact Us

Data and analysis does not represent the actual or expected future performance of any investment product. We believe the information, including that obtained from outside resources, to be correct, but we cannot guarantee its accuracy. The information is subject to change at any time without notice. The data contained herein is the result of analysis conducted by Natixis Investment Managers Solutions’ consulting team on model portfolios submitted by Investment Professionals.

Natixis Investment Managers Solutions collects portfolio data and aggregates that data in accordance with the peer group portfolio category that is assigned to an individual portfolio by the Investment Professionals. At such time that a Professional requests a report, the Professional will categorize the portfolios as a portfolio belonging to one of the following categories: Aggressive, Moderately Aggressive, Moderate, Moderately Conservative, or Conservative.

The categorization of individual portfolios is not determined by Natixis Investment Managers Solutions, as its role is solely as an aggregator of the pre-risk attributes of the Moderate Peer Group and will change over time due to movements in the capital markets.

Portfolio allocations provided to Natixis Investment Managers Solutions are static in nature and subsequent changes in a Professional’s portfolio allocations may not be reflected in the current Moderate Peer Group data. Investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, international and emerging markets. Additionally, alternative investments, including managed futures, can involve a higher degree of risk and may not be suitable for all investors. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

5490846.1.1