5 Midyear Trends in Model Investment Portfolios – Summer 2022

Natixis Investment Managers Solutions model investment portfolio consultants monitor asset classes, investment products and market action, both in real time and from a historical perspective. See which trends influenced financial advisors’ asset allocation decisions in their moderate model portfolios halfway through 2022.

Read on... or download the full article here.

US Portfolio Trends – Q2 2022

Additional insights into alternatives, inflation-protected assets, asset allocation trends, and risk in moderate model portfolios.

Stock/bond correlations spiked in 1H 2022, leading to the two largest “diversification failures” since 1988. With equity and fixed income both down, alternatives categories were top performers.

S&P 500 vs. Bloomberg Aggregate (1988-2022)

| Asset Category | Q1 2022 | Q2 2022 | 1H 2022 |

| Systematic Trend | 10.5% | 5.4% | 15.9% |

| Event Driven | -0.2% | -3.3% | -3.3% |

| Short-Term Bond | -2.9% | -2.0% | -4.9% |

| Bank Loan | -0.5% | -5.2% | -5.7% |

| Nontraditional Bond | -2.5% | -4.2% | -6.7% |

| Multisector Bond | -4.3% | -6.1% | -10.2% |

| Intermediate Core Plus Bond | -5.9% | -4.9% | -10.5% |

| Long-Short Equity | -2.7% | -7.1% | -9.7% |

| High Yield Bond | -4.0% | -9.3% | -13.0% |

| Large Blend | -5.2% | -14.9% | -19.3% |

| Foreign Large Blend | -7.0% | -13.1% | -19.2% |

| Diversified Emerging Markets | -8.7% | -12.2% | -19.9% |

| Small Cap Blend | -6.3% | -14.7% | -20.1% |

Source: Natixis Investment Managers Solutions, FactSet, Morningstar. Data as of 6/30/2022.

In a challenging environment across many different asset categories, top quartile portfolios tended to have lower allocations to equities and higher allocations to cash and alternatives.

Source: Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 215 moderate portfolios submitted for review from January to June 2022. Data as of 6/30/2022.

Source: Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 215 moderate portfolios submitted for review from January to June 2022. Data as of 6/30/2022.

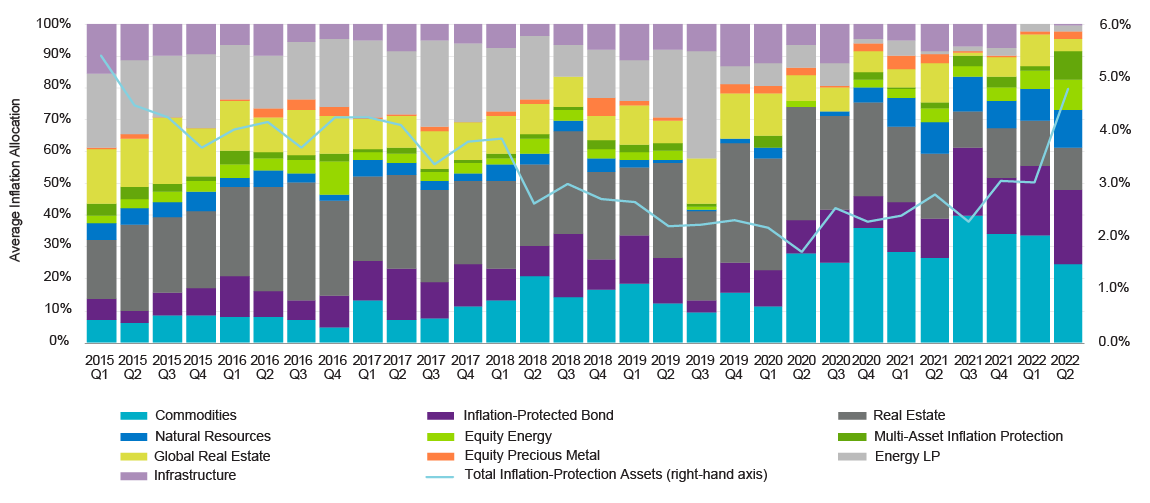

Inflation fears continued to dominate conversations as the CPI rose at a pace not seen for decades. Our hypothetical inflation-sensitive portfolio outpaced the S&P 1500 by 12% in 1H 2022. Allocations to inflation-protection assets approached 5.0%, their highest level since 2015.

Natixis IM Solutions Hypothetical Inflation-Sensitive Portfolio

| Industries | Weight | Sector |

| Equity Real Estate Investment Trusts | 25.0% | Real Estate |

| Food Products | 5.0% | Staples |

| Household Products | 5.0% | |

| Tobacco | 5.0% | |

| Oil Gas & Consumable Fuels | 10.0% | Energy |

| Energy Equipment & Services | 2.5% | |

| Metals & Mining | 10.0% | Materials |

| Chemicals | 2.5% | |

| Road & Rail | 5.0% | Industrials |

| Construction & Engineering | 5.0% | |

| Machinery | 2.5% | |

| Electric Utilities | 7.5% | Utilities |

| Gas Utilities | 5.0% | |

| Banks | 10.0% | Financials |

| Total Allocation | 100% |

1H 2022 Returns

| Asset Category | Q1 2022 | Q2 2022 | 1H 2022 |

| Inflation-Sensitive Portfolio | +5.6% | -12.7% | -7.8% |

| S&P 1500 | -4.6% | -16.0% | -19.9% |

| Outperformance | +10.2% | +3.3% | +12.1% |

Source: FactSet, Natixis Investment Managers Solutions. For illustrative purposes only. There is no guarantee that an investment in any particular industry will result in a profit or protect against loss in an inflationary market.

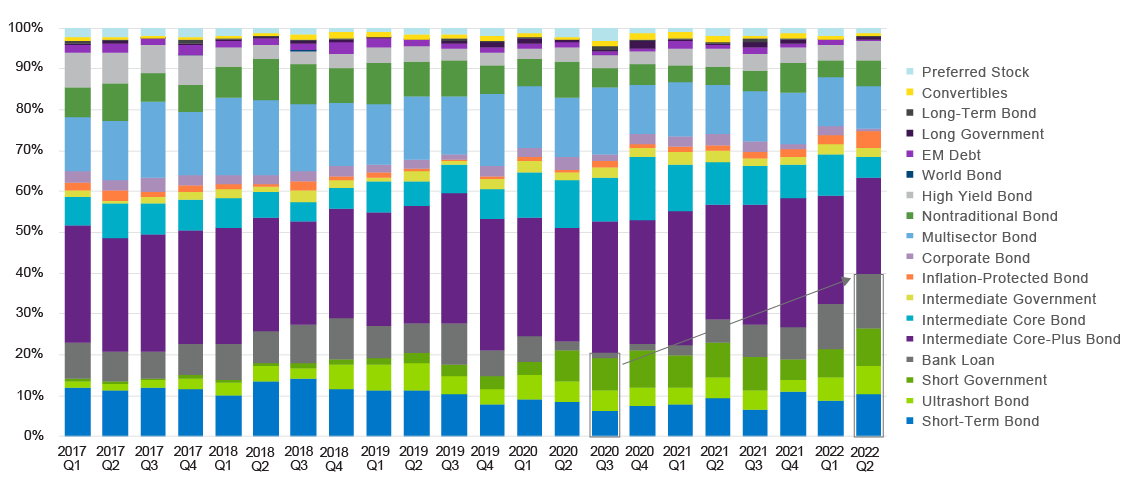

We continue to see higher allocations to short duration bonds and bank loans, mostly coming from core or core plus bond exposures that typically carry more duration. The average fixed income portfolio duration declined to 4.1 years.

Fixed Income Allocations Over Time

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 215 moderate portfolios submitted for review from January to June 2022. Data as of 6/30/2022.

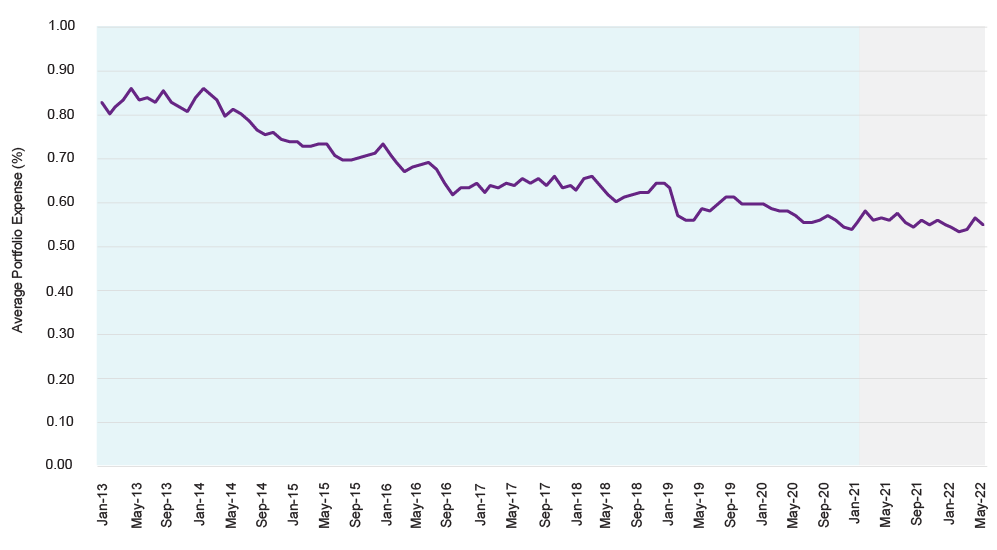

After 8 years of declining expense ratios, portfolio level fees have remained flat since 12/31/2020.

Moderate Portfolio Expense Ratio Over Time

Source: Natixis Investment Managers Solutions. The Portfolio Analysis & Consulting Moderate Risk Peer Group is based on 215 moderate portfolios submitted for review from January to June 2022. Data as of 6/30/2022.

Contact Us

Submit your model portfolio for in-depth analysis including sources of risk, return, and diversification.

Contact Us

The data contained herein is the result of analysis conducted by Natixis Investment Managers Solutions’ consulting team on model portfolios submitted by Investment Professionals.

Natixis Investment Managers Solutions collects portfolio data and aggregates that data in accordance with the peer group portfolio category that is assigned to an individual portfolio by the Investment Professionals. At such time that a Professional requests a report, the Professional will categorize the portfolios as a portfolio belonging to one of the following categories: Aggressive, Moderately Aggressive, Moderate, Moderately Conservative, or Conservative.

The categorization of individual portfolios is not determined by Natixis Investment Managers Solutions, as its role is solely as an aggregator of the pre-risk attributes of the Moderate Peer Group and will change over time due to movements in the capital markets.

Portfolio allocations provided to Natixis Investment Managers Solutions are static in nature and subsequent changes in a Professional’s portfolio allocations may not be reflected in the current Moderate Peer Group data. Investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, international and emerging markets. Additionally, alternative investments, including managed futures, can involve a higher degree of risk and may not be suitable for all investors. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

4891095.2.1