The Art – and Science – of Building Better Model Portfolios

Model portfolios are playing an increasingly important role in many advisors’ practices, improving scalability and ensuring a more consistent client experience. There are other benefits, too. Financial professionals surveyed by the Natixis Center for Investor Insight indicate that 45% use models to access a wider range of asset classes more efficiently and 42% find that using models lowers the administrative burden.1

But as models become more mainstream, advisors are raising the bar for their portfolio providers. These rising expectations come as no surprise to Marina Gross, Co-Head of Natixis Investment Managers Solutions. Her consulting team has analyzed more than 15,000 advisor models since 2012. “Over the years our in-depth reviews have provided some unique insights into the way advisors view risk, asset allocation, manager selection and portfolio returns,” she notes. “Advisors are growing more sophisticated in their use of models and they do expect more.” Addressing these concerns has helped guide and inform innovation and portfolio construction in the Natixis models.

Diverse Network of Managers

Gross points out that building and managing models leverages other key strengths of Natixis Investment Managers. Thanks to its multi-affiliate structure, independent thinking is part of the Natixis DNA. “We’re fortunate to have highly skilled and experienced management teams who are well-versed in multi-asset portfolio construction. We have a broad network of active managers to choose from – as well as a rigorous due diligence and manager review process to identify best-in-class passive strategies and non-affiliated managers when necessary.”

Guiding Principles: Active and Passive

The Natixis models reflect the belief that strategic, qualitative diversification is essential for pursuing alpha potential and managing risk. “Access to multiple asset managers supports meaningful diversification that reduces the chance of investments being managed in the same way,” says Christopher Sharpe, Chief Investment Officer and Portfolio Manager. He adds that as technology continues to increase the efficiency of the capital markets, restricting a portfolio to an all-active or all-passive strategy shortchanges investors because there are distinct benefits and risks associated with both investment approaches.

In Sharpe’s view, “There is significant investment value to be gained from combining active and passive strategies, not only in the form of improved cost and tax efficiencies, but also in the ability to flex the portfolio across exposures, styles and time horizons to create more balance and broaden the opportunity set.”

Diverse Range of Strategies to Target Advisors’ Needs

Differences in model type, construction and allocation in the Natixis models create a robust menu of portfolio options that can be used as core, completion, or thematic portfolios tailored to a range of risk profiles.

Once the model type has been selected, the construction approach can be either quantitative or fundamental, the allocation approach can be either dynamic or strategic, and the tax strategy can also be specified. For example, the construction approach of the Tactical Core Models is fundamental, the allocation is dynamic, and the portfolio is tax-aware.

The offering also includes thematic models that focus on sustainable investing and income generation. “Responding to the needs of advisors and their clients has been the driving force behind growing our model business,” says Marina Gross. “We expect that advisors will continue to demand more from their model providers in the years ahead.”

1 Natixis Investment Managers, 2020 Global Survey of Financial Professionals, conducted by CoreData Research March – April 2020. Survey included 2,700 financial professionals in 16 countries.

Investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

Diversification does not guarantee a profit or protect against a loss.

All asset allocation scenarios are for hypothetical purposes only and are not intended to represent a specific asset allocation strategy or recommend a particular allocation. Each investor's situation is unique and asset allocation decisions should be based on an investor's risk tolerance, time horizon and financial situation.

Asset allocation models are intended for informational purposes only and should not be construed as a recommendation or investment advice, as the allocations provided do not take into account the investment objectives, risk tolerance, restrictions, liquidity needs or other characteristics of any one particular investor. Unlike passive investments, there are no indexes that an active investment attempts to track or replicate. Thus, the ability of an active investment to achieve its objectives will depend on the effectiveness of the investment manager.

Natixis Investment Managers Solutions does not provide tax or legal advice. Please consult with a tax or legal professional prior to making any investment decisions.

But as models become more mainstream, advisors are raising the bar for their portfolio providers. These rising expectations come as no surprise to Marina Gross, Co-Head of Natixis Investment Managers Solutions. Her consulting team has analyzed more than 15,000 advisor models since 2012. “Over the years our in-depth reviews have provided some unique insights into the way advisors view risk, asset allocation, manager selection and portfolio returns,” she notes. “Advisors are growing more sophisticated in their use of models and they do expect more.” Addressing these concerns has helped guide and inform innovation and portfolio construction in the Natixis models.

Diverse Network of Managers

Gross points out that building and managing models leverages other key strengths of Natixis Investment Managers. Thanks to its multi-affiliate structure, independent thinking is part of the Natixis DNA. “We’re fortunate to have highly skilled and experienced management teams who are well-versed in multi-asset portfolio construction. We have a broad network of active managers to choose from – as well as a rigorous due diligence and manager review process to identify best-in-class passive strategies and non-affiliated managers when necessary.”

Guiding Principles: Active and Passive

The Natixis models reflect the belief that strategic, qualitative diversification is essential for pursuing alpha potential and managing risk. “Access to multiple asset managers supports meaningful diversification that reduces the chance of investments being managed in the same way,” says Christopher Sharpe, Chief Investment Officer and Portfolio Manager. He adds that as technology continues to increase the efficiency of the capital markets, restricting a portfolio to an all-active or all-passive strategy shortchanges investors because there are distinct benefits and risks associated with both investment approaches.

In Sharpe’s view, “There is significant investment value to be gained from combining active and passive strategies, not only in the form of improved cost and tax efficiencies, but also in the ability to flex the portfolio across exposures, styles and time horizons to create more balance and broaden the opportunity set.”

Diverse Range of Strategies to Target Advisors’ Needs

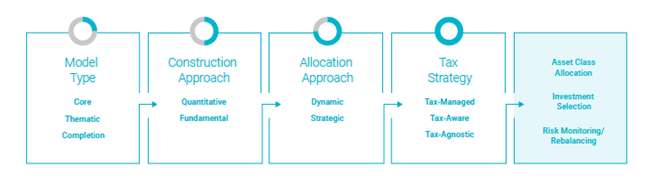

Differences in model type, construction and allocation in the Natixis models create a robust menu of portfolio options that can be used as core, completion, or thematic portfolios tailored to a range of risk profiles.

Once the model type has been selected, the construction approach can be either quantitative or fundamental, the allocation approach can be either dynamic or strategic, and the tax strategy can also be specified. For example, the construction approach of the Tactical Core Models is fundamental, the allocation is dynamic, and the portfolio is tax-aware.

Consistent Model Portfolio Construction Process

Source: Natixis Investment Managers Solutions

The offering also includes thematic models that focus on sustainable investing and income generation. “Responding to the needs of advisors and their clients has been the driving force behind growing our model business,” says Marina Gross. “We expect that advisors will continue to demand more from their model providers in the years ahead.”

Investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

Diversification does not guarantee a profit or protect against a loss.

All asset allocation scenarios are for hypothetical purposes only and are not intended to represent a specific asset allocation strategy or recommend a particular allocation. Each investor's situation is unique and asset allocation decisions should be based on an investor's risk tolerance, time horizon and financial situation.

Asset allocation models are intended for informational purposes only and should not be construed as a recommendation or investment advice, as the allocations provided do not take into account the investment objectives, risk tolerance, restrictions, liquidity needs or other characteristics of any one particular investor. Unlike passive investments, there are no indexes that an active investment attempts to track or replicate. Thus, the ability of an active investment to achieve its objectives will depend on the effectiveness of the investment manager.

Natixis Investment Managers Solutions does not provide tax or legal advice. Please consult with a tax or legal professional prior to making any investment decisions.

3928793.2.1