Fixed Income Framework: Cyclicality vs. Inflation

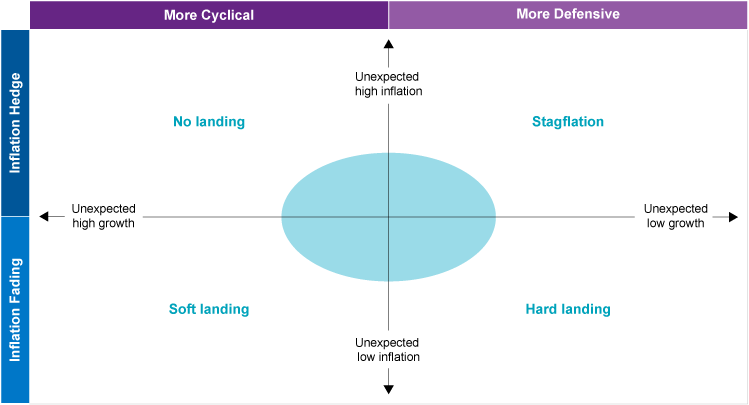

Hard landing? Soft landing? No landing? Stagflation? Much of the volatility over the past several months can be boiled down to the market repricing inflation and growth. On the equity side, we’ve helped a variety of clients align their portfolios with their market outlook through our cyclicality vs. inflation framework (Figure 1). This framework scores equity strategies based on exposures to industries that have shown a historical tendency to outperform in the four possible scenarios of growth and inflation coming in higher or lower than expected:

- Growth stays resilient, inflation comes under control (Soft landing)

- Growth stays resilient, inflation remains sticky (No landing)

- Growth slows, inflation comes under control (Hard landing)

- Growth slows, inflation remains sticky (Stagflation)

Figure 1 – Cyclicality vs. Inflation Framework: Equities

Source: Natixis Investment Managers Solutions

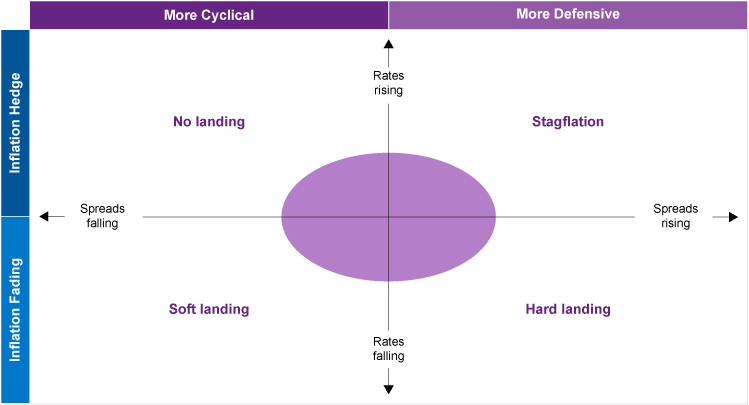

This also has an interesting analog in fixed income. Resilient growth is good for credit spreads. Inflation coming under control is good for interest rates and duration exposure (Figure 2):

- Spreads compress, Treasury yields fall (Soft landing)

- Spreads compress, Treasury yields rise (No landing)

- Spreads expand, Treasury yields fall (Hard landing)

- Spreads expand, Treasury yields rise (Stagflation)

Figure 2 – Cyclicality vs. Inflation Framework: Fixed Income

Source: Natixis Investment Managers Solutions

Balanced Exposure to Four ScenariosWhich fixed income asset classes give balanced exposure to each of the four quadrants?

- In general, corporate bonds would outperform in soft landing, benefiting from the decline in both rates and spreads.

- Bank loans would do well in the no landing scenario, with the floating-rate profile protecting investors from rising rates, while prices likely increase from spread compression.

- Treasury bonds should do best in the hard landing scenario, in a risk-off flight to quality where rates rally.

- Treasury bills or money markets would hold up best in stagflation, when almost nothing else works.

Figure 3 – Comparative Performance of Fixed Income Asset Classes – 1/1/23–4/30/23

|

Performance Rank |

Treasury Bills | Treasury Bonds | Corporate Bonds | Bank Loans |

| January 2023 | 4 | 3 | 1 | 2 |

| February 2023 | 1 | 3 | 4 | 2 |

| March 2023 | 3 | 1 | 2 | 4 |

| April 2023 | 4 | 3 | 2 | 1 |

| Year to date | 4 | 3 | 1 | 2 |

Performance rankings based on the following indices: Bloomberg US Treasury Bills, Bloomberg US Treasury, Bloomberg US Corporate Investment Grade, S&P/LSTA Levered Loans 100.

What About Money Markets and T-Bills?So far this year, many investors have happily sat in money market funds and earned an attractive short-term yield. But stagflation is the only environment of the four where being in T-bills or money market accounts is the best decision for your fixed income portfolio. According to the framework, putting all of your eggs in that basket is a bet that rates and spreads will both rise. No conviction would be having something in all four baskets.

Investors without much conviction on short-term market direction can hold a diversified basket of stocks with the ability to outperform in a variety of outcomes. Similarly, investors without much conviction on short-term market direction can hold a diversified basket of bonds with the ability to outperform in a variety of outcomes. The future is unknown and we would encourage positioning your portfolio for more than one scenario. If the majority of your fixed income allocation is still in T-bills or money market accounts, that means adding duration and potentially even adding some exposure to credit spreads. It’s the best way to hedge your bets.

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Natixis Investment Managers, or any of its affiliates. The views and opinions are as of April 17, 2023 and may change based on market and other conditions. There can be no assurance that developments will transpire as forecasted, and actual results may vary.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Investors should fully understand the risks associated with any investment prior to investing.

This material may not be redistributed, published, or reproduced, in whole or in part. Although Natixis Investment Managers believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy or completeness of such information.

This document may contain references to copyrights, indexes and trademarks that may not be registered in all jurisdictions. Third party registrations are the property of their respective owners and are not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis”). Such third-party owners do not sponsor, endorse or participate in the provision of any Natixis services, funds or other financial products.

Provided by Natixis Distribution, LLC, 888 Boylston St., Boston, MA 02199. Natixis Investment Managers includes all of the investment management and distribution entities affiliated with Natixis Distribution, LLC and Natixis Investment Managers S.A. Natixis Advisors, LLC provides advisory services through its division Natixis Investment Managers Solutions. Advisory services are generally provided with the assistance of model portfolio providers, some of which are affiliates of Natixis Investment Managers, LLC.

5679186.1.1